Ideas Inc. and BHP Billiton have teamed up to create the Empower Business Program for Saskatchewan First Nations and Métis entrepreneurs. The program will help entrepreneurs get the resources and training they need to start and grow their businesses.

The program is taking applications from December 1, 2012 to January 31, 3013. Interested entrepreneurs should visit the Ideas Inc. website or send an email to empower @ saskatoonideas.com. If you are thinking of starting a business and you qualify for the program, this would be an excellent way for you to get help in getting your business of the ground.

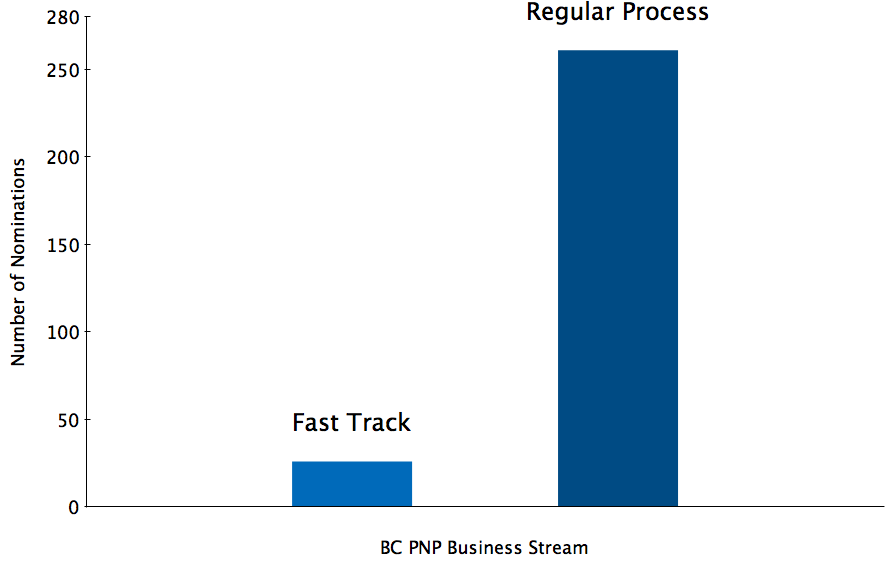

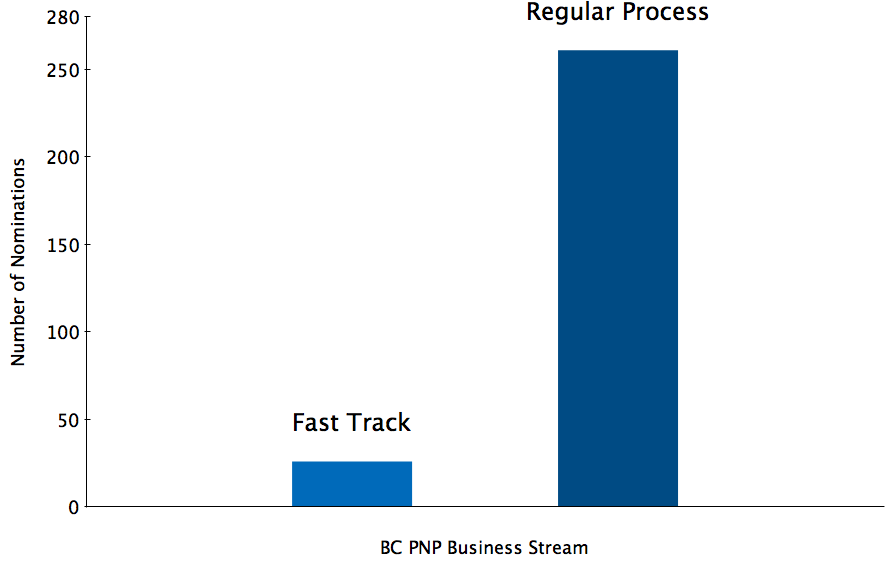

The BC PNP has two options through the business immigration stream – the Fast Track nomination option and the regular process. As of November 15, 2012, the government is suspending the Fast Track option as it reviews the effectiveness of the program.

Under the Fast Track option, business applicants who had obtained a PNP-supported work permit and had arrived in BC could request immediate nomination for permanent residence if they posted a $125,000 bond with the Province. The bond would be refunded once the applicant met his or her obligations under the program.

Under the regular process, there is no performance bond and applicants are only nominated once they have established a business.

Since 2007, 26 Fast Track nominees have completed their performance agreements compared with 261 business applicants who have gone through the regular process.

Although BC is suspending the Fast Track option while the review is being conducted, this will have no impact on the regular process in the business immigration stream. This change will have an impact on some immigrants, but for the vast majority of immigrants under the business stream of the BC PNP, BC remains open for business.

Take a look at the immigration trends infographics below (via Niren & Associates(https://www.visaplace.com)). They reflect the positive impact that immigration is having on the Canadian population.

Courtesy of: Niren & Associates

This program was eliminated in the 2015/2016 budget.

The SBLA program is a provincial government program that is administered through local community-run loan associations. An individual business can borrow up to $20,000 to start or expand a business.

Eligible Borrowers

The program is meant to provide financing to new businesses or existing businesses that want to expand. It is meant to fill the funding gap to finance businesses that traditional banks or credit unions might find too risky. The program’s goal is to help entrepreneurs who might not otherwise find financing to start their businesses.

Eligible Loan Purposes

- equipment

- renovations

- start-up inventory

Non-eligible Loan Purposes

- direct farming

- mining or oil extraction

- residential real estate

- multi-level marketing

- operating expenses

- repayment of existing debt

Loan Terms

The local community loan associate will set the interest rate but the maximum rate is capped at 10 percent. Loans are granted for a two to five year term.

Loan Application Process

Entrepreneurs can contact either their local community loan association or the SBLA program office at Enterprise Saskatchewan at sbla@enterprisesask.ca or 306–787–4707. Prospective borrowers will be required to provide the following information to their local community loan association, which will then review the material and make a lending decision. Decisions are partly based on the number of jobs the business will bring to the community and the services the business will provide.

The SBLA is a good option for some borrowers. It can provide seed capital that can make the difference between starting or not starting a business for many entrepreneurs. If you feel like the program might meet your needs, it’s worth giving your local association a call.

Industry Canada is proposing major changes to the CSBFA that would take effect April 1, 2013. The proposal is currently under a 30 day consultation period that began last Saturday.

The main changes to the current program are:

- The maximum interest rate would increase by 0.75% to prime + 3.75% or the residential mortgage rate + 3.75%

- Banks would be able to charge higher loan administration fees. These fees are capped under the current program.

- The personal guarantee provided by the shareholders of a corporation could be 100% of the loan amount. Personal guarantees are limited to 25% of the total loan amount under the current program.

Industry Canada wants to make these changes because the number of loans granted under this program have dropped from 18,000 in 1999-2000 to 7,466 in 2010-2011. Banks complain that the program is difficult to administer and that they don’t make enough money on the loans. These changes are supposed to help change that and get more of these government guaranteed loans in the hands of small business owners.

The increase in the interest rate and fees will cost businesses more when they borrow under this program but that isn’t my main concern. The proposed 100% guarantee will expose the shareholders of a company to full personal liability for the loan amount. I believe that this rule change will reduce the number of entrepreneurs willing to take a chance on starting a business.

The current 25% guarantee ensures that the shareholders have “skin in the game” but that that their losses will be manageable if the business fails. The 100% guarantee would make the losses far less manageable for many people.

I’ve seen many situations where a group of small investors pool their funds and take out a CSBFA loan to start the business. One shareholder runs the business day to day and the others help out when they can because they typically work at regular jobs. Entrepreneurs like this can justify their participation if they can limit their losses to their cash investment in the company and 25% of the loan amount. Increasing this to 100% will prevent many people from starting a business in a scenario like this.

The Clarence Campeau Development Fund has created the Métis Women’s Equity Program and the Métis Youth Equity Program (18-35 years old).

The Métis Women’s Equity Program

The Métis Women’s Equity Program offers equity assistance of up to 65% of project costs to a maximum of $10,000. Total project costs cannot exceed $25,000, (excluding working capital). The funds can be used to purchase an existing business, start a new business or expand or renovate an existing business.

The funds are repayable over a maximum 5 year term and are interest free. After 24 months of satisfactory repayment the client has the option to repay 75% of the remaining contribution with 25% being forgiven. Security consists of a promissory note, which means that no assets need to be pledged as collateral.

The business must be for profit and have a sound business plan. The applicant must put 5% equity into the business and the business must be 100% owned by a Saskatchewan Métis Woman.

Métis Youth Equity Program

The Métis Youth Equity Program offers equity assistance of up to 65% of project costs to a maximum of $10,000. Total project costs cannot exceed $25,000, (excluding working capital). The funds can be used to purchase an existing business, start a new business or expand or renovate an existing business.

The funds are repayable over a maximum 5 year term and are interest free. After 24 months of satisfactory repayment the client has the option to repay 75% of the remaining contribution with 25% being forgiven. Security consists of a promissory note, which means that no assets need to be pledged as collateral.

The business must be for profit and have a sound business plan. The applicant must put 5% equity into the business and the business must be 100% owned by a Saskatchewan Métis Youth

For more information, contact the Clarence Campeau Development Fund

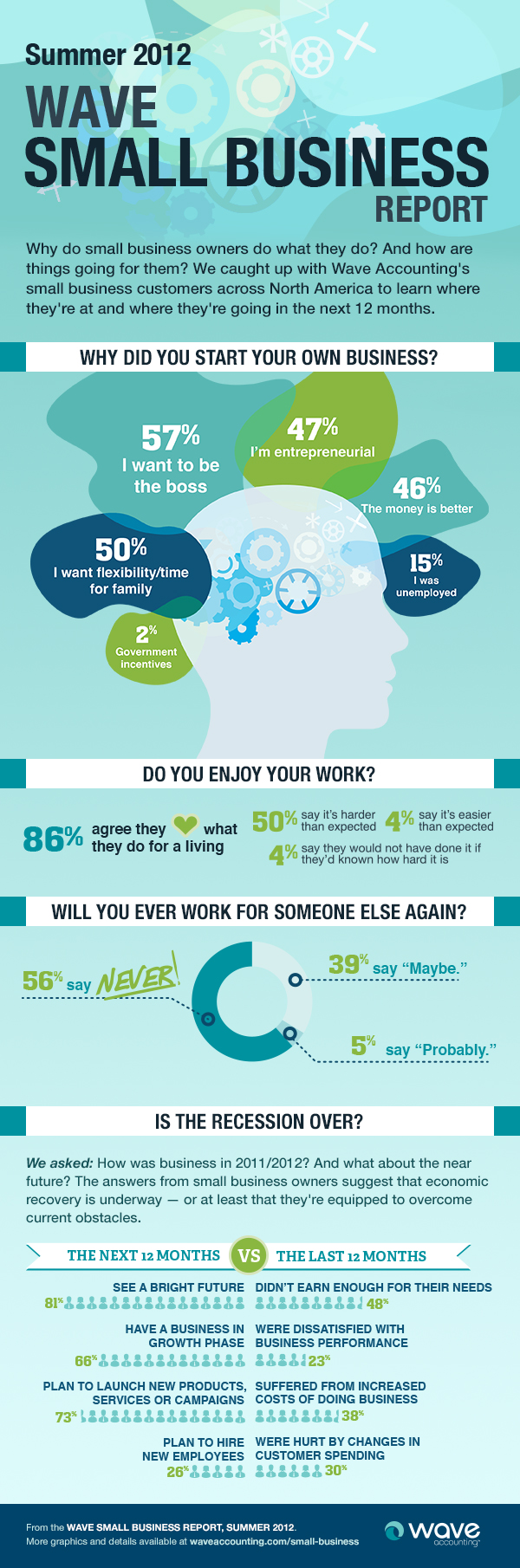

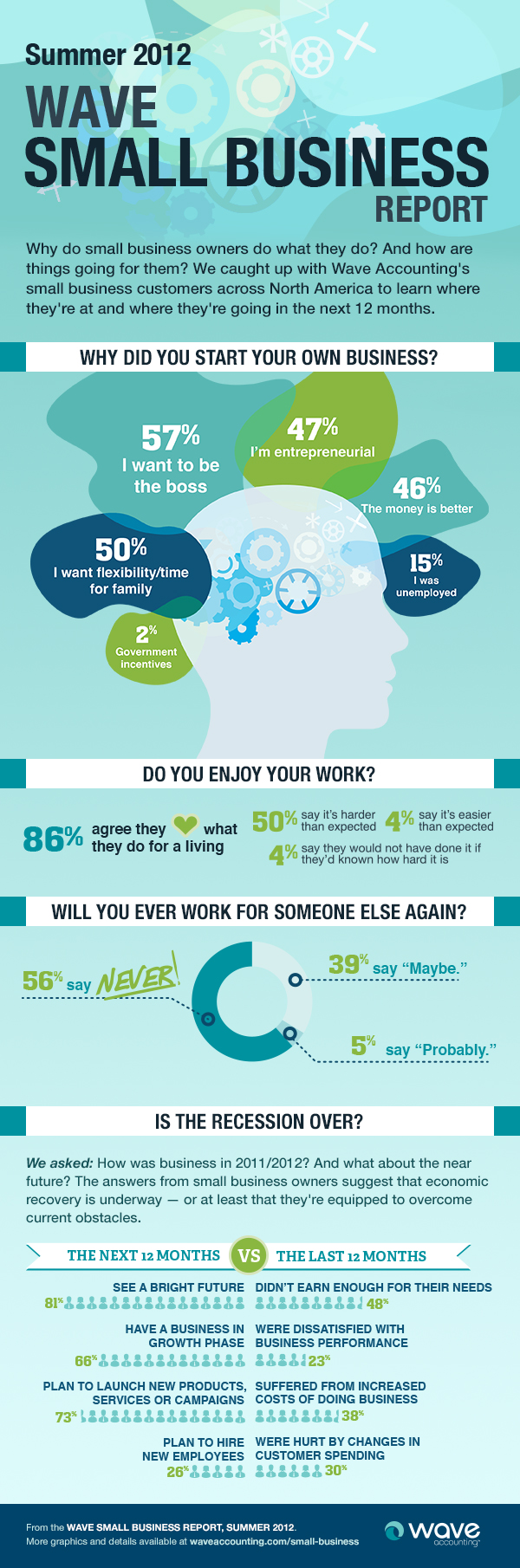

The folks over at Wave Accounting have released the results of their small business survey. The nifty info-graphic below is courtesy of them.

The Federal Government is going to launch consultations to develop a startup visa to attract entrepreneurs.

It is important to understand what this means in the context of the different types of entrepreneurs. Details on this startup visa are still scarce but it seems that the government will be looking for scalable startup entrepreneurs rather than the more common small business entrepreneurs that are currently accommodated under existing entrepreneurship programs.

Entrepreneurs under this program will likely need to arrange venture capital investment before immigrating. This will mean that it will only apply to entrepreneurs in industries that are capable of exponential growth, such as software.

This effort is part of a competition with other countries for top entrepreneurial talent. The United States has been making efforts towards a startup visa for some time. Currently, it appears that the bill is stalled in the legislative process.

This leaves Canada with an opportunity to gain an edge in the competition for these talented entrepreneurs. Hopefully the consultative process will move quickly and we can put a sensible policy in place to attract these entrepreneurs.

Vancity is sponsoring a competition to help post-secondary and recent post-secondary graduates grow for-profit businesses that have a positive social or environmental impact.

Applicants must submit an 8 page business plan that includes a description of the positive environmental or social impact of the business. Vancity personele will judge the plans based on their merits and up to 10 applicants may be selected to move on to the next phase of the competition. All qualified applicants will get feedback on their business plans, regardless of their ranking by the judges.

The application deadline for submitting a business plan is 12:00 p.m., Friday, March 16, 2012. Finalists will be announced on Monday, March 26, 2012.

Finalists will be invited to pitch their businesses to the contest’s judges. The pitches will take place on Wednesday April 4, 2012.

Winners will be announced on April 25, 2012 at an award ceremony in Vancouver. The prizes are:

- 1 first prize of $50,000

- 1 second prize of $25,000

- 1 third prize of $15,000

This contest is a good opportunity for student entrepreneurs to gain recognition for their companies. The full terms and conditions can be found on the Vancity website.

The Centre shopping mall in Saskatoon is running an entrepreneurship contest for Saskatoon entrepreneurs. The contest is eligible to Saskatoon area residents over the age of 18 who have a business plan and the financial backing to start their business. The winning business must be able to be operated at The Centre.

Prices include 3 months of rent-free retail cart space, a Web Presence Business Starter Plan from BlackSun, and a $500 signage start up among others. The winning entrepreneur will be required to participate in the media campaign surrounding the contest. In many ways, this exposure is probably the most valuable part of winning the competition.

The Centre also has a special entrepreneur contest just for kids. The kids portion of the contest is open to those 17 years of age and younger. Kids need parental consent to enter the contest and may have to submit product samples if asked. The prize for the winner of this competition is a $1,000 RESP.

If you fit the criteria, it’s probably worthwhile to enter the contest. The exposure it brings would be valuable. The deadline for entries is 6pm February 15, 2012. Applications for adults and kids can be found here.