It turns out that we aren’t very good at predicting the future. A sober look at the predictions of economists, political pundits, and sportscasters reveals this lack of foresight.

What is more surprising, is that we do a very poor job of predicting our own futures. It’s difficult to predict how much we will like a certain situation. Part of the reason for this is that we are unable to completely imagine all the details of a certain situation. If you are imagining running your own business, you might be thinking of how much fun it will be to design products or come up with clever marketing campaigns. You might not be imagining setting up an accounting system, filing your taxes, or meeting with your banker. Imagination has a way of filling in some details while leaving others out. The problem is that some of the details that get left out might be very important.

It’s not possible to completely imagine what running your own business will be like. The best way to remedy this is to talk to other business owners who run a similar business to yours. Learn from their experience. They will be able to give you a much more complete picture of what your experience of running that type of business will be like.

If you can find a business owner that is willing, spend a few days job shadowing him or her. Asking questions, while experiencing some of the business’s activities firsthand, will be very valuable.

This might seem like a lot of effort to learn about something you think you already understand. Trust me, your romantic image of business ownership isn’t accurate in all respects. You are about to invest your hard earned money and take substantial financial risks. Do your research first.

The Bank of Canada announced today that it is leaving its overnight lending rate at 1%, which is what is has been all year. Governor Mark Carney commented that economic uncertainty had increased in the past few weeks and that the recession in Europe was more pronounced than expected.

Canada’s big bank economists expect the rate to remain at this level throughout most of 2012.

There’s an old analogy that illustrates being involved versus being committed.

A breakfast made of bacon and eggs beautifully illustrates the commitment of the pig vs. the compliance of the chicken. The chicken is involved, but it is the pig that is fully committed.

In a way starting a business is a lot like this. You can be involved. You can make some initial inquires, ask people what they think and dream about starting your business. You want everyone else to do the initial work for you. You have shown an interest that has gotten you involved in the process, but you are not truly committed.

If you were truly committed you would be doing considerable research on your own. You would be making phone calls and investigating start up costs. You would find out what it will take to run the business successfully. You would talk to other business owners in your space to find out what advice they could give you that would increase your chance of being successful. You would talk to potential customers to find if they would be willing to purchase what you have to offer.

You would then complete an effective business plan to make sure that you understand all of the details of starting and running your business. If the prospects for the business were good, you would implement your plan.

You need to ask yourself early on whether starting a business is an idle fantasy or something you are going to roll up your sleeves and do. Are you merely involved or are you committed?

An import letter of credit (import documentary credit) is issued by a bank at the request of an importer. The letter of credit states that the bank will pay a specified sum of money to a beneficiary, normally an exporter, on presentation of particular, specific documents.

If you are importing goods into Canada, you can go to your bank to request an import letter of credit. The bank will evaluate your credit worthiness much like it would for a loan. This is because it is making a promise to pay the exporter of the goods on your behalf. The bank wants to make sure that in the end it can get the money from you. For importers who do not have a long history with the bank or those who have newer businesses that don’t have significant assets, the bank may require collateral in support of the letter of credit. There will be a fee for this letter of credit ranging from 0.5% to 2% of the letter of credit amount.

The letter of credit is a promise from the importer’s Canadian bank to pay the exporter of the goods as long as they are shipped in accordance with specified instructions and conditions. A contract is created between the Canadian bank and the exporter of the goods.

The Canadian bank will sent the letter of credit to the exporter’s bank. The exporter’s bank will then let the exporter know that it is ok to ship the goods. The exporter will draw a draft against the Canadian bank in accordance with the terms of the letter of credit, attach the required documents, and present the draft to his own bank for payment.

The exporter’s bank will send the letter of credit and associated documents to the Canadian bank for payment. If all the terms and conditions in the letter of credit have been complied with (meaning the goods have been delivered) the Canadian bank will pay the exporter’s bank. The Canadian bank will request payment from the importer.

What this series of transactions does is trade the creditworthiness of the importer and the exporter, who may not know or trust one another, for the creditworthiness of their banks. The two banks will presumably know and trust another and have had many other dealings with each other. The importer and exporter each trust their own banks, and the banks trust each other. This makes the transaction much safer than if the importer and exporter dealt with each other directly.

If you are importing significant quantities of product as part of your business, you should speak to your bank about setting up one these letter of credit facilities. One failed transaction could be very costly. Off-setting the risk of this may well be worth the cost of a letter of credit.

The Fuel Awards, a competition meant to inspire entrepreneurship and recognize top entrepreneurs under 30, has announced its winners.

HiretheWorld helps businesses hire, manage and pay online workers

Kenshi Arasaki, 28 - A Thinking Ape - Vancouver

A Thinking Ape is a mobile development company that makes applications for smart phones.

A subscription service that allows members to try beauty products in the comfort of their own home before buying them full-sized.

John Carbrey, 29, - Intrafinity - Toronto

An innovative design and software company providing practical solutions for today’s medium and large-sized organizations.

Lauren Friese, 28 - TalentEgg - Toronto

TalentEgg is Canada’s career hub for students and new graduates that are looking for meaningful student jobs, entry level jobs, summer jobs and internships, and co-op job opportunities.

Dave Hale, 23, - Soshal Group - Ottawa

An agency focused on social intelligence, strategy and media.

Alexander Levy, 24 - MyVoice - Toronto

An application for mobile phones that help people with speech and language issues.

Simon Rouillier, 28, NVI - Montreal

A web design and interactive strategy company.

Josh Sookman, 28, - Guardly - Toronto

A mobile safety service that connects you to family and friends or the police with one tap of an on screen panic button.

Kyle Vucko, 26, - Indochino - Vancouver

An online menswear store that sells custom made suits.

Edward Yao, 24, - TeamBuy.ca - Toronto

A group buying discount site.

Congratulations to all the winners. I encourage you to click through on the links to their individual websites. There are some really cool businesses in this list.

I’m in the process of reading the new Steve Jobs biography and it gives the details about the famous story of Jobs and his engineers visiting the Xerox PARC research centre to learn about the graphical user interface the Xerox engineers had developed.

The legend that had always been told about this event was that Jobs convinced Xerox to give them a look at their technology, which Jobs then stole for the Macintosh. What really happened is that in exchange for letting Xerox’s venture capital arm invest in Apple’s next round of private financing, Jobs negotiated a deal where he would be allowed full access to the technology being developed at PARC.

The conventional wisdom that had gone along with this event was that if Xerox had just realized what they had, they could have came to dominate the computer industry. The interesting thing is that Xerox did launch a product based on their ideas.

The Xerox Star was launched in 1981 with a focus on the business market. A workstation sold for $16,000 and required 2 or 3 other workstations and a file server and a name server/print server to be useful. A full system would be $50,000 to $100,000. The system had a bit mapped screen and the graphical user interface we’re all now familiar with.

Xerox only shipped about 25,000 units and it was considered a commercial failure. The high price and poor user experience were contributing factors.

Compare this to the Macintosh which launched in January 1984 at a price of $2,495.

The Macintosh’s price point immediately made it accessible to more people. Apple’s engineers had taken Xerox’s designs and innovated on them to produce a computer that was easier to use and more capable than the Xerox effort. The Macintosh went on to be a huge success.

The lesson here is that having a good idea isn’t enough. Doing something that delivers the potential of the idea in way that creates value for people is everything.

I was reading an article recently about how a once dominant player in the print advertising industry had fallen on hard times and was now attempting to remake itself as a digital marketer that put small businesses online by giving them websites. What disturbed me about this new business model was that the company would essentially “own” the small business’s sites and unless the business owners continued to pay the monthly fee, their sites would be taken down.

A small business’s website is a very important piece of online real estate. It’s important that you have full control over this asset. There is a lot written these days about how important social media sites like Facebook, Twitter and Google+ are. Some “experts” would suggest that these days you don’t really need a traditional website and that your business can just live on these social sites. This would be a mistake.

Social media sites are valuable because they allow for easy communication with customers and potential customers. They should be a valuable part of your business’s marketing mix, but building your whole online presence on them would be a mistake. The business models of these social media companies are always evolving because they are all marginally profitable at best. The agreement you have with them today, might not be the agreement you have tomorrow.

I strongly recommend that you purchase your own .com or .ca domain and set up your own website. It’s true that you will have to pay a monthly fee for web hosting but if you don’t like your web host, you can always cancel your account and take your website’s files and put them on another host.

It has become more popular in recent years to build company websites on blogging platforms like Wordpress, Squarespace and Weebly. These can be good tools because they allow people without the skills to write their own code to build to build and design a site themselves. A Wordpress site you self-host on a web hosting account that you pay for is probably the best choice because it will give you the most control over your site and your data. You may be able to export some of your data out of the other two platforms but it will be more difficult.

The bottom line is that you are better off having your own website on your own domain, even if it is built on one of these platforms. If in the future you decide to redesign your site, it may be a lot of work to transition off a platform but at least you’ll have people coming to a domain that you own and that people are used to finding your business at.

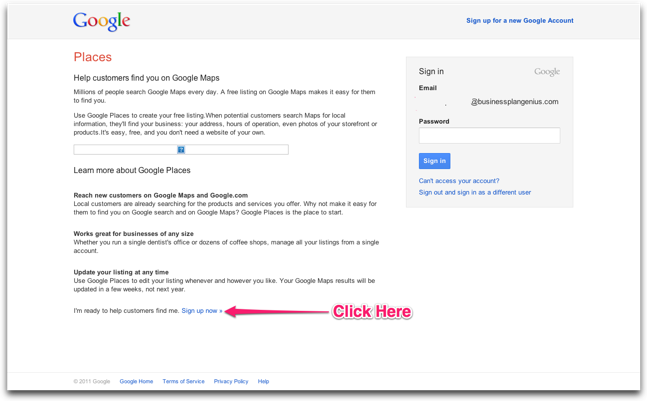

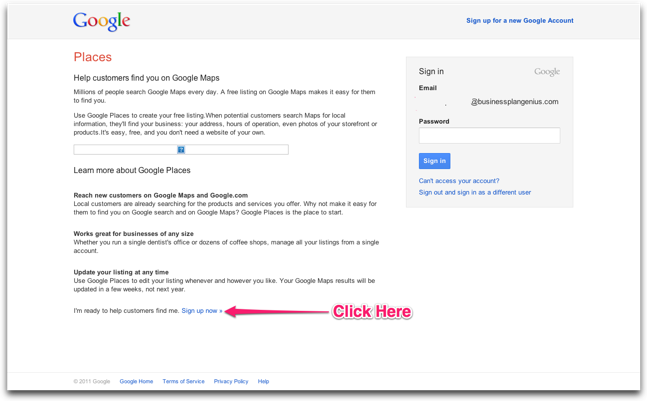

Claiming your business’s listing on Google Places For Business is an important step in improving your visibility in Google searches. In this post, I’ll provide a tutorial on how to take ownership of your business’s listing.

The screenshot shown above is the Google Places For Business Landing Page. The look of it may vary, depending on whether you have a Google account and are signed in. In the version I have posted here, the link to continue onward isn’t obvious so I’ve marked it with an arrow.

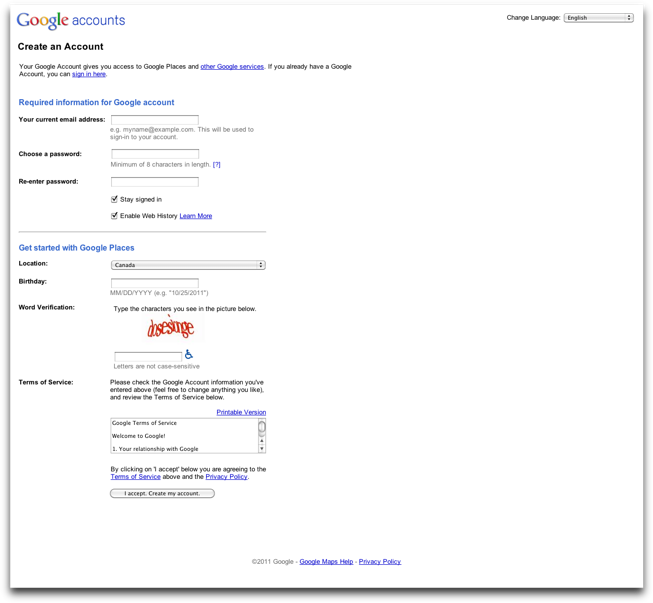

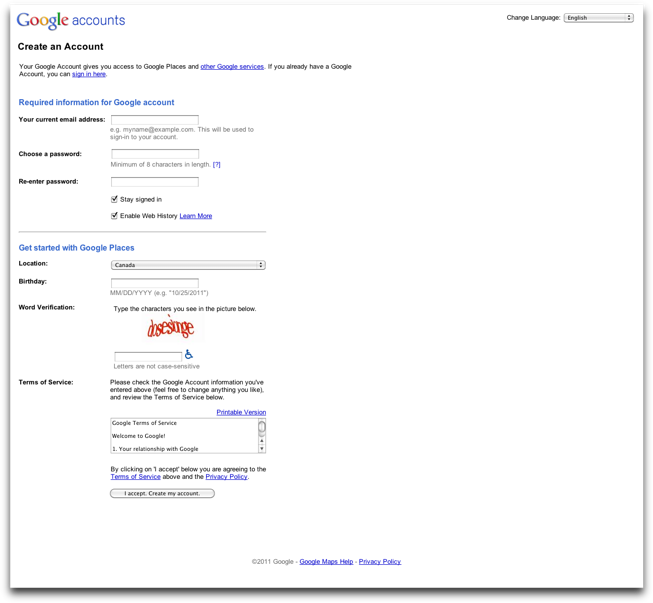

If you don’t already have a Google account, you’ll be asked to create one. This is will allow you to complete your Google Places For Business listing and you’ll be able to sign up for Google’s other services as well.

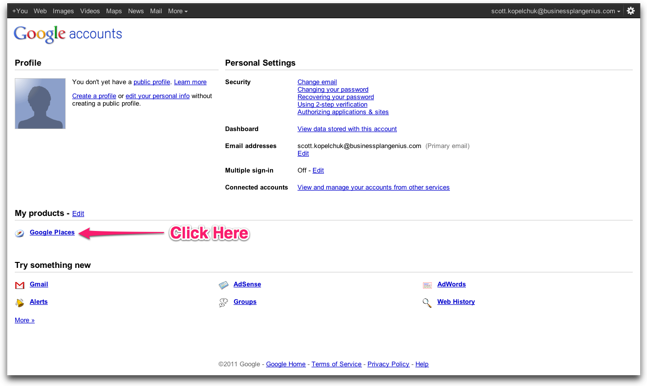

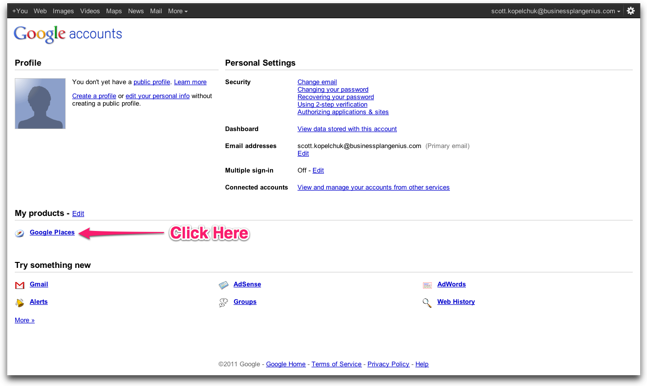

The screenshot above shows the main page once you’ve created your Google account. I’ve indicated the Google Places link.

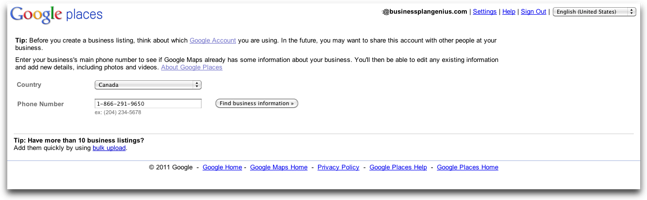

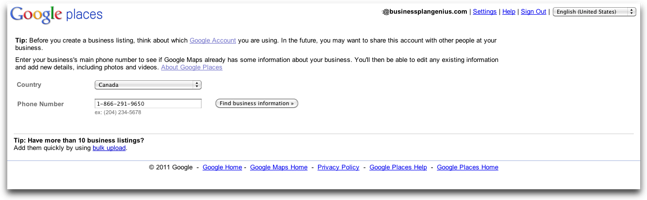

This is the first page of the sign up process. When putting in your phone number, make sure you use the same one that you have listed on your business website (if you have one).

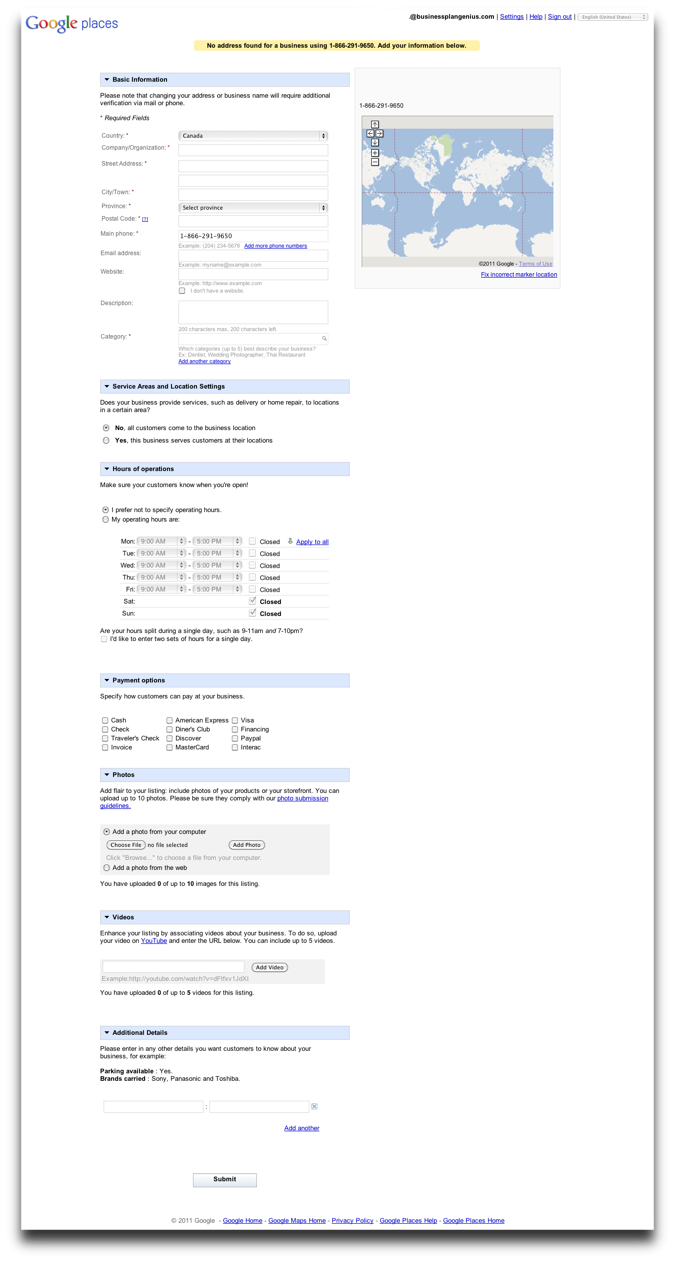

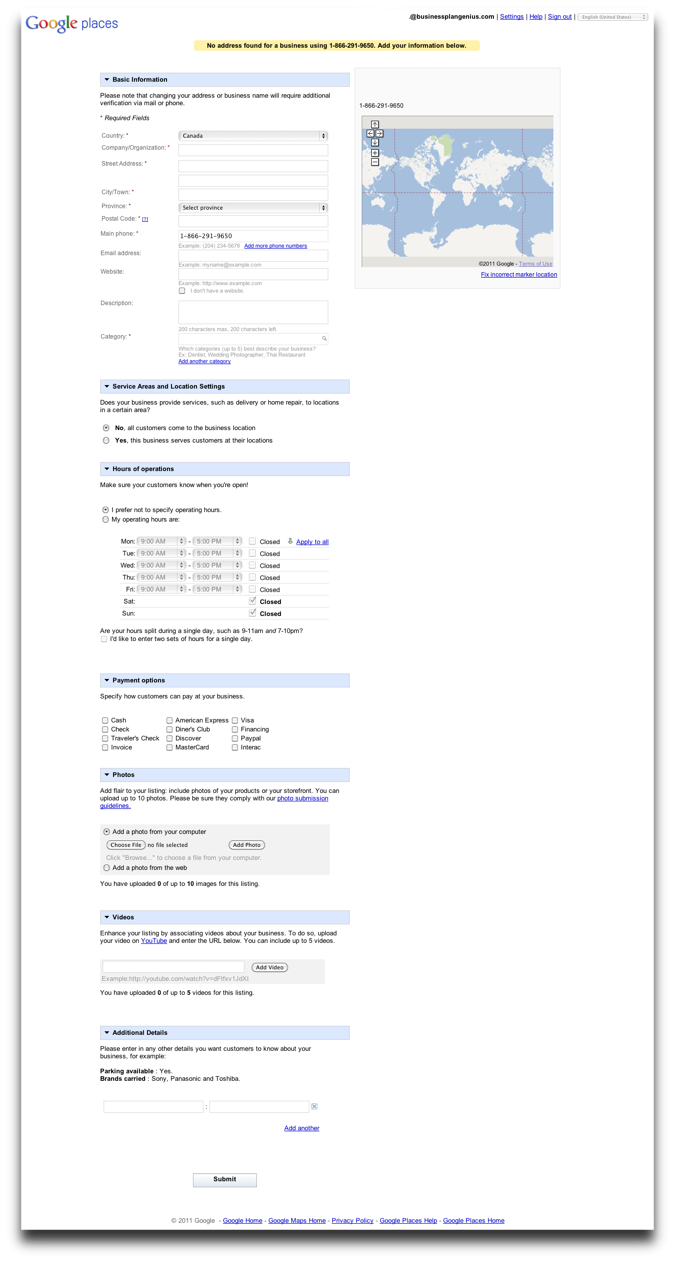

This page shows all the information that you can add to your Google Places for Business local listing. Make sure you fill out as much detail as you can. You should upload pictures of your storefront. It will help people identify your business when they are trying to find it on the street.

A more complete listing gives the customer confidence that your business is legitimate and that it is worth visiting. It also provides additional search terms for Google to index. This increases the likelihood that your business will show up when a customer searches using terms related to your products or services.

Once you have filled out this form, you will have created your listing. Remember to update your listing whenever your information changes. An inaccurate listing will only confuse and frustrate your potential customers. Google also provides statistics on how many times your profile was viewed in the previous 30 days. It’s worthwhile signing in every once in a while to check these statistics and think about what you can do to your listing to improve the number of actions people take compared to the number of impressions (people viewing your Google listing) your listing gets. Not everyone who views your listing will take an action but you want this ratio to be as high as possible.

If you have any questions about Google Places For Business, please leave a comment below.

Over the past week or so, I’ve had the need to search for businesses that sell products that I don’t purchase regularly. When looking for a place to purchase a product I’m not familiar with, I usually turn to Google to find business listings. I have a copy of the yellow pages but I don’t think I’ve opened it in over a year. I use the online version of the yellow pages rarely because their site is poorly designed and it takes too long to find what I want.

I don’t think I am alone in my search methods. People are going online more and more to find the products they want to purchase, even if they intend to make the purchase locally in a physical store. This makes the Google Places listing for your business very important.

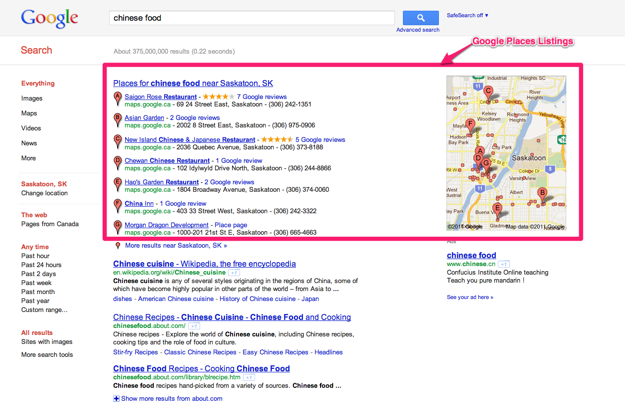

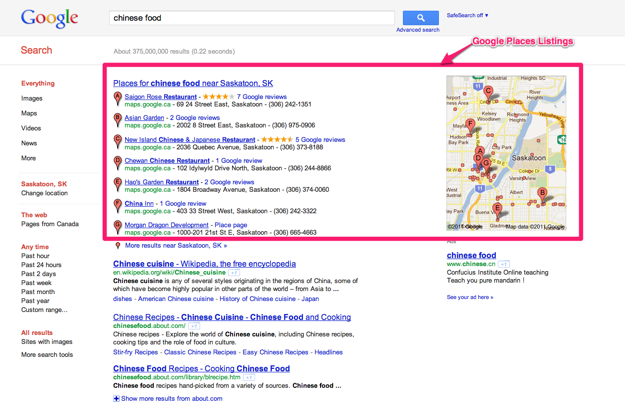

Here are some listings for Chinese food restaurants.

The seven listings I’ve marked are Google Places for Business listings. Being in this list of seven is very important because if a potential customer sees a business that is nearby and offers what he or she wants, the search will end there. This person isn’t going to click to go deeper in the local results or look further down the page to find your listing.

The good news is that you can take ownership of your Google Places For Business listing. In my experience, most business owners haven’t done this and this means their business is poorly represented, if it is represented at all.

In a future blog post, I’ll explain how to take ownership of your Google Places For Business Listing.

If you are an undergraduate student at one of Canada’s universities, you have the opportunity to enter the Enterprize Canada Business Plan Competition and to compete for the $15,000 first prize. Contest entrants will be given feedback on their business ideas and their business plans by the panel of preliminary judges. Past competitors will work with contest entrants to help them refine their pitches to the judges.

The competition is broken down into 4 rounds:

Qualifying Round (October 1 - December 3, 2011)

To enter this round, teams are required to submit a 5 page abstract of their business idea. The judges will choose 10 teams per region to move forward in the competition.

Regional Round

Teams will be required to submit a 15 page business plan. They will be required to travel to the host school in their region where they will present their plan to a panel of judges. The host schools are:

- University of British Columbia - B.C. and Alberta participants

- University of Guelph - Manitoba, Ontario and Saskatchewan participants

- Concordia University - Québec participants

- Mt. Allison University - New Brunswick, Nova Scotia, Prince Edward Island, & Newfoundland and Labrador

Three teams from each of the regions will be selected to compete in the national competition.

Semi-Final And Final Rounds

These final two rounds of the competition will take place in Vancouver at the Hyatt Regency Hotel on February 10-12, 2012.

If you are an undergraduate student with an idea for a business, this is good opportunity to get help with your business idea. Winning the competition would not only get you the prize money, but an initial boost of publicity for your business.