People come up with ideas for new businesses every day. How does one judge whether an idea has merit or not? Should the business be pursued or should the idea be tossed on the scrap heap of bad ideas? Here is a process you can follow to find out.

A feasibility study is used to test a business concept. It takes into account the strengths, weakness, opportunities and threats (SWOT) of the proposed business’s environment and the resources it has at hand to try to evaluate the business’s chances of success.

The first step is to come up with a hypothetical business model that you can test based on the research and analysis you conduct in the feasibility study. I recommend following the Business Model Generation method.

Next, you would conduct research designed to inform the analysis needed to test the assumptions you made in the business model. This may involve talking to potential customers, gathering information on your market and competitors, and getting quotes on all costs involved, among other things.

Once you have information in hand, you can start your analysis. In general, for a feasibility study, I would conduct the following analysis:

Environmental Analysis

- trend analysis

- industry analysis

- internal analysis (an assessment of your skills vs what the business requires)

- market profile analysis

Financial Analysis

- analysis of similar firms in the industry

- projected market share

- break even analysis

- proforma analysis

- ROI projections

- margins

If you complete the analysis described above, you should be in a good position to make a decision about whether or not to proceed.

If you decide to proceed, you would then create a business plan to describe the day to day operations of your business. Much of the analysis done in the feasibility study stage will be brought into the business plan so it should be relatively easy to create.

A feasibility study is a lot of work and it is difficult to do well, but it is a step than should not be skipped for a business with a new business model. The risks are just too high. It’s better to find out that a business doesn’t work in the feasibility study stage rather than after you’ve invested your hard earned money. While “No, don’t do this” might not be what you want to hear, consider it a set back. There are plenty more ideas in the world. Take what you’ve learned, pick another idea, and take another shot at it.

The book, Business Model Generation: A Handbook for Visionaries, Game Changers, and Challengers, written by Alexander Osterwalder and & Yves Pigneur defines the term business model as:

A business model describes the rationale of how an organization, creates, delivers, and captures value.

This is a very good definition, however I think it is important to understand the difference between a business model and a business plan.

A business organizes its assets and activities into a system that it uses to deliver value to the customer. This system may vary widely from business to business depending on the industry it is in and the approach it is taking. For example, a restaurant has a different business model that a tire shop. This is easy to see. Amazon has a different business model than your local retail seller of books. This might be more difficult to see as they both sell books.

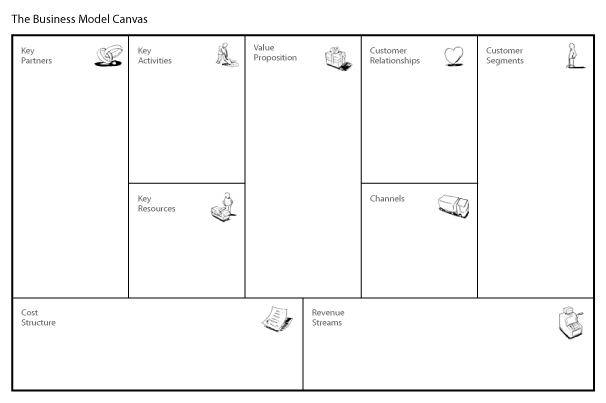

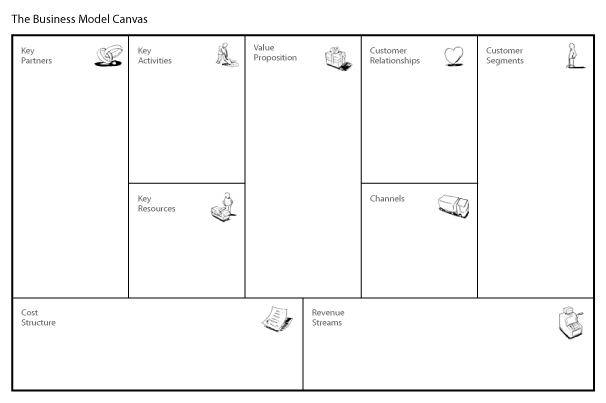

To help explain this difference, I’ve included a graphic from the above mentioned book that nicely organizes a business model into separate areas.

When you look at categories like cost structure, channels, and key activities it becomes clearer how Amazon is different than your local bricks and mortar retail book seller.

Note that the business model gives a thumbnail sketch of how the business will be organized and what it will be doing. It does not provide a plan for how this system will work or how it will be implemented. That’s where the business plan comes in.

What does all this mean for you, the person wanting to start a small business? If you are starting with a business model that has been existence for while and other people are successfully running businesses using it, you can proceed to the business planning stage. If you are starting a business with a business model that is significantly different that what has been tried before or if a particular business model has a short rack record, you should spend time developing your business model. This will often involve conducting a feasibility study to test your business concept.

For 80%-90% of you out there who are looking to start small businesses, a proven business model exists for what you are doing and you can proceed to the business planning stage. The rest of you have a longer road to travel.

The Government of Canada’s Business Services For Entrepreneurs website defines a business plan as:

“A business plan is a written document that describes your business, its objectives and strategies, the market you are targeting and the financial forecast for your business. It will assist in setting realistic and timely goals, help secure external funding, help measure your success, clarify operational requirements and establish reasonable financial forecasts. Preparing your plan will help you focus on how your new business will need to operate to give it the best chance for success.”

This is a good definition of what a business plan is but I think it is important to describe what a business plan is not:

- The business plan is not where you come up with your business idea. This should be completed before you get to the business planning stage.

- It is not for developing a business model. A business model is a system for making money. Some businesses have straightforward business models that have stood the test of time. Some businesses have business models that need to be tested because they are blazing a new trail. Your business model should be settled before you get to the business planning stage.

- It is not a feasibility study. A feasibility study is used to test a business idea to see whether it stands a good chance of becoming a successful business. There is some overlap between a business plan and a feasibility study but studying feasibility is an investigation and not a plan. Lessons learned in the feasibility stage can be applied to the business planning stage.

For an idea that is not unique and has proven business models built around it in other neighbourhoods or cities, a feasibility study may not be necessary. It’s important to understand where you are in the process of starting a business. Trying to complete the process out of order or trying to skip steps will limit your chance at success.

A common topic of discussion with my clients is how much debt is the right amount. This is a big question. Not enough debt can restrict your growth and too much debt can destroy your business. How can you tell if you have too much or too little debt? Since it’s the start of golf season, how about a golf analogy?

A loan is like a high tech, long distance driver to a business. When used properly, it can add distance to your game and lower your score. It can’t, by itself turn you into a better golfer. In fact, a top tier driver in the hands of a wild golfer will increase scores because the off-center hits will result in even wilder misses.

In a business, if you have solid revenues and have good control over your costs, debt can be a great way to make your investment work for you. The increased power the loan provides will greatly benefit your bottom line. If you have fluctuating revenues and are subject to wide fluctuations in costs, the increased power of a loan can wreck you if you can’t make your payments.

The one point where this analogy breaks down is the role of the banks. Yes, they are selling you the loan (driver), but they aren’t overly concerned with your score. It’s more like they are renting you golf balls. As long as you return them at the end of the round (interest and principal payments), they don’t care if you shoot 70 or 105.

Hopefully this analogy sheds a bit of light on how your debt structure affects your business. Until next time, keep it in the short grass!

When scouting locations for your new business, you can be beset with a variety of choices. Picking the location for your business is one of the most important choices you will make. Your success or failure rests on this. This blog will give some insight into what the important considerations are.

Where are your customers? This is by far the most important consideration. You need to be where your customer can reach you when he is in a buying mood. For example, putting a family restaurant in the industrial section of town is a mistake. In order to make the best choice, you need to know your customer. Where do they currently get the product or service you wish to provide? If you miss this, you could have the best product, best customer service and satisfaction and still fail. It’s like the philosophical question “If a tree falls in the forest and nobody is around to hear, does it make a sound?” In the case of a poorly located business, the sound is your cash register, and the answer is NO.

Do you want to buy or lease? Unlike the first question, there is no simple answer to this. Leasing is an attractive option for owners without a lot of cash. It also is good if the lessor can attract your target market. Buying is a better option for those with ample funds because owning tends to be less expensive than leasing. In addition, as the owner of the premises, you have much more control over what happens to your store. New lessors can’t come in and force you out if you own the property.

How much do you want to pay? Obviously, your capital or lease payments have to fit in your business plan. Unfortunately, many entrepreneurs look for the best rate or price as the first consideration in picking locations. The trouble with this is if you choose a location where there isn’t a market, the location could be free and the business would still fail. If you can’t raise the capital to get into the right location, the best choice is to raise more capital. Choosing your location based on price will be the undoing of your business.

Choosing your location is vital to your success. If you use these three considerations, you should have a good chance of making the right choice.

The Canadian Youth Business Foundation (CYBF) has partnered with Spinmaster to launch the Spinmaster Innovation Fund. The fund will offer financing, mentoring and support for up to 10 young entrepreneurs.

Spinmaster was started by three Toronto entrepreneurs in the mid 1990s. The company has grown to be a successful toy maker, well known for its Air Hogs line of toys. The founders have decided to partner with the CYBF to give back to the entrepreneurial community.

Each entrepreneur will be eligible for up to $50,000 of startup financing. There is no collateral required and there are no principal payments required for the first year of the loan’s amortization. Interest rates start at Prime + 2.0% and can decline over the life of the loan should all payments be made on time. A loan with these terms and interest rate is a very good deal for the entrepreneur. Typical bank financing for this type of business would likely require collateral with a much higher interest rate.

Each of the entrepreneurs will receive mentoring through the CYBF’s mentoring program. They will also have access to some of Spinmaster’s executives during the first two years of operating their business. The successful entrepreneurs will be given a paid trip to Toronto for a two day Innovation Launch Pad Workshop where they will be taught business skills by the Spinmaster team.

The application process is as follows:

- Call For Applications - CYBF will start taking applications on April 27th, with the call for applications closing on June 9th, 2011. Each application will require a business plan.

- Application Review - The evaluation committee will review applications throughout July and August. They will narrow the applicants down to 18 semi-finalists.

- Pitches - During August 17th & 18th, the finalists will pitch their presentations to the selection committee.

- Innovation Launch Pad Workshop - The 10 winners will be announced and they will attend the workshop on September 24th & 25th.

The contest is open to Canadian entrepreneurs 18 to 34 years of age. The business must have been in operation for less than a year and it must have a business plan with good prospects for profitability. The business must be majority owned by qualifying age individuals. The applicants need to work in the business full time and cannot be full time students.

The application process is fairly straightforward. The entrepreneur will need a business plan prepared according the CYBF’s template, resumes for each individual applying and a couple of references. There is an online loan application that will also need to be filled out.

For any of you young entrepreneurs out there, this a contest worth entering. The financing is a sweetheart deal, you’ll have access to the mentorship of the entrepreneurs behind Spinmaster and the contest exposure can only help your business.

For further information check out the CYBF’s Spinmaster Innovation Fund website.

The Bank of Canada decided to leave its overnight lending rate at the current level of 1%. This is the rate that the banks base their prime lending rate on. This is good news as the cost of borrowing will remain stable for small business loans based on prime at least until the Bank of Canada’s next meeting on May 31st. The Bank noted that the economy is growing slightly faster than expected. Trying to predict the future is a bit of a fool’s errand but it seems to me that rate hikes are likely as the economy strengthens.

I’m an engineer by trade, and while I don’t do much “engineering” anymore, I still think like one. One apt lesson for entrepreneurs is to plan their business with the care and rigour of an engineer.

The number one priority for an engineer is to protect public safety. It is the reason why engineers are licensed. The iron ring that engineers in Canada wear is a symbol of the oath to protect public safety above all other considerations. It’s easy to see why. Mistakes in engineering cause catastrophes like collapsed bridges, crashed airplanes and factory explosions.

To avoid these disasters, engineers use safety factors. When specifying a material for a structure, an engineer will use a factor that will provide three to four times as much strength as is required by design calculations. Bridges, levees and other water structures are designed to withstand beyond one-in-100 year flood levels. This is due to the high danger of failure compared to relatively low cost of increased safety. In addition, engineers know that real life will never be the same as the drafting table (for those younger readers, that’s what engineers used before computers). Flaws in materials, workmanship, and design as well as changes in usage and wear and tear all eat away at these safety factors. Finally, regardless of the skill of the engineer and tradesperson, things will happen that nobody anticipates.

This isn’t to say that planes don’t crash and factories don’t blow up. It’s impossible to eliminate risk totally. Even if you could, your project would become so expensive it wouldn’t be feasible. The best engineers balance risk and cost. They provide the safety required while not destroying the budget.

So what does this mean to an entrepreneur? A failed business doesn’t kill people or do widespread environmental damage. It can, however, destroy personal wealth for the entrepreneur, investors and employees. Much of the risk in business failure can be dealt with in the planning stage. For instance:

- In the design phase, the engineer will rely on measurements in the field. This is like basing the sales and marketing assumptions on research. Yes, it’s possible to start a business on a hunch, but the success is due more to fortune than skill.

- An engineer will sometimes specify a material with properties that exceed requirements. This is because of things like fatigue and corrosion. An entrepreneur does this by building a management team with skills beyond what appears to be immediately necessary.

- The engineering safety factor is like the amount of cash the entrepreneur has to invest in the business. Our plans come with a standard level of three months cash on hand at all times. This means that there is enough cash retained to cover payroll and all fixed costs for three months.

- When an engineer discovers a flaw in the design, it’s back to the drawing board. Nobody dies or gets hurt. When an entrepreneur finds a flaw in her plan, she can rework it to get it right. Nobody goes broke.

In summary, using the engineering method will not guarantee success in business. No plan can totally eliminate risk. However, using these methods will help you build your business to be strong and durable enough to protect your time and investment.

There are many reasons people look at going into business for themselves. It could be that they hate their current job and yearn to be their own boss. Maybe a tradesperson feels that he or she could run a better business than the company they work for. It’s important that people go into business for the right reasons. Failure lurks around every corner and if someone is in business for the wrong reasons, he or she is much more susceptible to it.

There has been some research on what makes an entrepreneur successful. One study found that the entrepreneurs they interviewed had the following characteristics in common.

- A propensity to take risks

- A need for achievement

- A belief in one’s ability to control the outcome of a situation

- A tolerance of uncertainty

- Self-confidence

- Innovativeness

- A need for autonomy

In my experience, these characteristics are useful in running a business. Different people have them to different degrees. Some of these characteristics are developed in the business owner as he or she becomes more experienced. The Business Development Bank of Canada, a federal crown corporation, has an online quiz that will test you in the attributes above.

It is important to have a passion for the industry the business is in. If someone starts a business based solely on where the best possible financial returns are and without passion for the space, it will be very difficult to succeed. Things will get tough, so tough that only a passion for the business can carry the business person through. A person without passion in this situation will quit before they become successful. Very few businesses become successful without experiencing a period of adversity.

It is important to have the right foundation in place before getting started. Most new businesses won’t be able to pay a predictable salary to the owner right away. If a business owner has an expensive personal lifestyle, he or she needs to be prepared to reduce that lifestyle to one the business can support.

A person starting a business also needs to be able to contribute cash towards the start of the business. Every business needs some cash to get started. The amount can vary widely depending on the nature of the business, from a few thousand for a home based business to millions for a manufacturing business. Some of this needs to come from personal savings, while the remainder can come from borrowing against personal assets or through business loans.

Family support is essential. Starting a business takes a lot of time and financial sacrifice. Starting a business without complete, informed buy-in from your spouse and family will lead to a lot of stress when things become difficult. This will compound the problems the business is having. While it is necessary to put some money at risk when starting a business, a business owner should never take a risk so large that failure would wipe his or her family out financially. Sure there are those stories of the plucky entrepreneur who maxes out his credit cards to start what becomes a billion dollar business. Unfortunately, the guy who did the same thing but had his business fail and push him into bankruptcy, costing him his marriage, never gets any press. He represents the vast majority of people that try this move.

Starting a business is difficult and requires a lot of hard work, but it can be very rewarding for those who prepare themselves well to accept the challenge.