The Canada Revenue Agency’s (CRA) My Business Account service is a self-serve website that allows you to perform a number of actions on behalf of your business. The website includes the ability to deal with the following topics.

- GST/HST

- Payroll

- Corporation Income Tax

- Excise duty

- Excise tax

- Excise tax on insurance premiums

- Air Travellers Security Charge

- Softwood Lumber Products Export Charge

- Registered charity

- Information Returns

- TFSA

- Partnerships

- Contract Payments (T5018)

It’s possible to file returns through the website and to provide other information to CRA. There is a message centre that gives up to date status information on your recent filings.

If you have multiple corporations, you can access them all from within the site by using a single set of login credentials. There will be a select box inside the site that allows you to go between businesses without having to log out and log back in again.

I’ve used the website and it is a significant improvement over dealing with CRA by fax, mail or over the phone.

The most difficult part of using the website is signing up to use it. It can be a bit confusing when trying to figure it out from CRA’s instructions on their website but it isn’t really that hard.

The first step is to create a set of user credentials. You have two options:

- Create a CRA user id and password

- Use a sign-in partner

You will want to use a sign-in partner, if at all possible. It’s the easiest option to use and maintain in the long term. This lets you use your login information at your bank or credit union to access the CRA’s website. SecureKey Concierge provides the service that brokers your credentials between your financial institution and the CRA. You can learn more about SecureKey Concierge in our previous blog post.

Creating CRA Credentials

If you choose the option to create credentials directly with CRA, click the CRA register button. This will take you through a series of forms that ask for information about you and your business. The CRA needs to ask these questions to determine your identity. You will need to provide:

- Your social insurance number

- Your postal code

- Your date of birth

- An amount from a previously filed tax return

The next step will be to create a user ID and password. You will then be asked to select and answer 5 security questions.

If you have done everything successfully you’ll get limited access to the CRA site. To get full access, you’ll need a CRA security code. This can be sent to you by mail or by email. If you choose mail you’ll have to verify your postal code against what they have on file for you. If you choose email, you will have to call CRA and they will email you a code. I recommend choosing email as the code can take a while to come by mail.

Once you have the security code, you can log into the site and provide your security code. Once you provide your business number, you will have full access to the services of the My Business Account service.

The CRA has summarized this in the video below.

Using a Sign In Partner

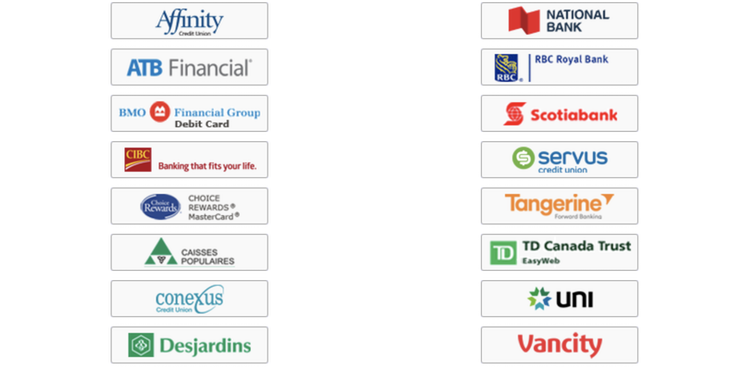

You can use a sign-in partner if your financial institution appears in the list of participating institutions. At the moment, the participating financial institutions are shown in the screenshot below.

Click on your financial institution’s logo and you’ll be taken to a login page on their site. Enter your normal online banking credentials and answer the security question. You will then be redirected back to the CRA where you will have to provide:

- Your social insurance number

- Your postal code

- Your date of birth

- An amount from a previously filed tax Returns

If you have done everything successfully you’ll get limited access to the CRA site. To get full access, you’ll need a CRA security code. This can be sent to you by mail or by email. If you choose mail you’ll have to verify your postal code against what they have on file for you. If you choose email, you will have to call CRA and they will email you a code. I recommend choosing email as the code can take a while to come by mail.

Once you have the security code, you can log into the site and provide your security code. Once you provide your business number, you will have full access to the services of the My Business Account service.

The CRA has summarized this in the video below.

The CRA’s My Business Account service is a good tool that can save you a lot of time. It’s well worth going through the small amount of time and effort to set up an account.